Finding yourself facing foreclosure can be overwhelming and frightening. But even in the midst of this storm, there are options and paths to navigate your way back to solid ground. This brief guide will cover the Virginia foreclosure laws and foreclosure process in Virginia. Although this is specifically tailored for Virginia homeowners, much of the information in this article will apply to homeowners facing foreclosure in different states or territories.

Understanding Virginia Foreclosure Laws:

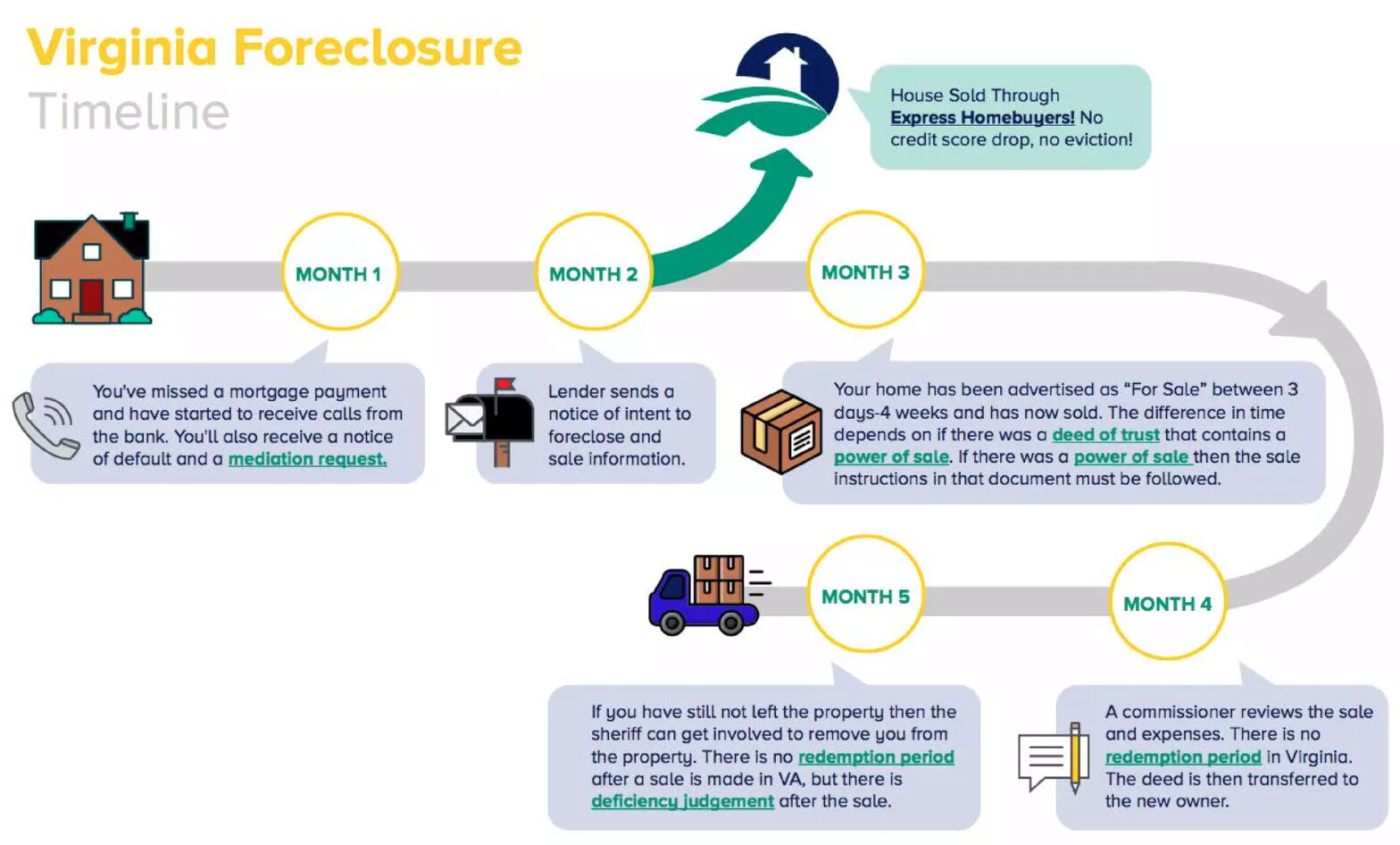

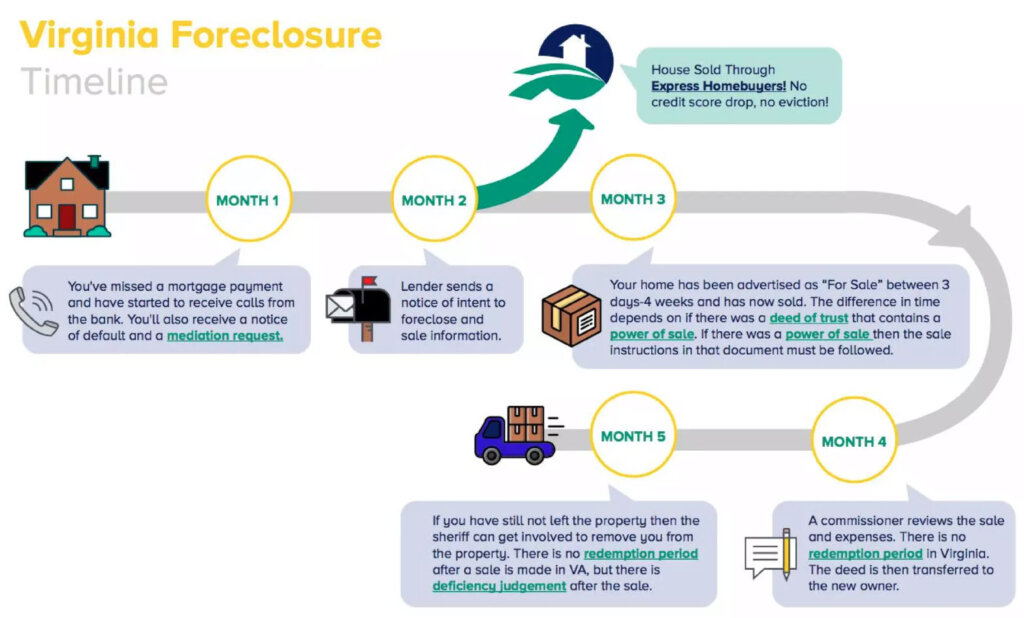

Virginia foreclosure primarily operates under non-judicial foreclosures, which means lenders don’t need court approval to proceed. Review some basic Virginia foreclosure laws and the foreclosure process in Virginia below:

- Default: Missing mortgage payments triggers the default process.

- Notice of Default: Expect a written notice informing you of missed payments and potential foreclosure.

- Right to Cure: You have a grace period (often 30 days) to catch up on payments and avoid foreclosure.

- Notice of Sale: If the default persists, the lender publishes a notice of sale and sends it to you.

- Foreclosure Sale: Your house is auctioned off to the highest bidder, typically after 60 days from the notice of sale.

Facing Foreclosure in Virginia? You Have Options:

Don’t feel like foreclosure is your only path. Explore these alternatives:

Loan Modification: A loan modification is a change to the terms of your existing loan, made by your lender. It’s essentially renegotiating your loan agreement to make it more manageable and prevent you from defaulting.

Here’s a breakdown of the key aspects of a loan modification:

What can be modified?

- Interest rate: This is often the most significant change, as lowering your interest rate will reduce your monthly payments.

- Loan term: Extending the loan term will spread out your payments over a longer period, making them smaller but increasing the total interest paid.

- Principal amount: In rare cases, your lender might agree to reduce the amount of money you owe, known as a principal reduction.

- Payment type: Changing the payment type, such as switching from interest-only to fixed-rate, can also be an option.

Why would a lender agree to a modification?

It’s actually often in the lender’s best interest to modify your loan rather than foreclose on your property. The foreclosure process in Virginia is expensive and time-consuming, and they may ultimately get less money back by selling the house through auction. A modified loan ensures they continue receiving payments on the debt, albeit under revised terms.

Who can benefit from a loan modification?

Homeowners facing temporary financial hardship due to job loss, illness, or other unforeseen circumstances are prime candidates for loan modifications. It’s a good option for borrowers who:

- Are behind on their mortgage payments but haven’t yet defaulted.

- Have good credit history before the hardship.

- Can demonstrate ongoing income to make the modified payments.

How do you get a loan modification?

- Contact your lender: Express your need for a modification and explain your situation. Be prepared to provide financial documentation like income statements and hardship letters.

- Gather required documents: The lender will ask for detailed financial information like bank statements, tax returns, and proof of hardship.

- Negotiate the terms: Discuss potential changes to your loan terms with your lender and aim for a solution that’s sustainable for both parties.

- Complete the modification process: Once an agreement is reached, you’ll need to sign new loan documents and fulfill any closing requirements.

Things to keep in mind:

- Loan modifications aren’t guaranteed, and approval depends on your individual circumstances and the lender’s policies.

- There may be upfront fees associated with modifying your loan.

- Make sure you understand the new terms completely and can comfortably afford the modified payments before agreeing.

If you’re struggling to make your mortgage payments, consider exploring a loan modification with your lender. It’s not a silver bullet, but it can be a valuable tool to avoid foreclosure and get back on track financially. Remember, seeking professional guidance from a financial advisor or housing counselor can be beneficial throughout the process.

Short Sale: In simplest terms, a short sale is the sale of a property for less than the outstanding mortgage balance on it. This means the homeowner receives less money from the sale than they owe to the lender. To proceed with a short sale, the homeowner needs to obtain permission from the lender, as they ultimately hold the lien on the property.

Why choose a Short Sale?

There are several reasons why a homeowner might choose a short sale over other options like foreclosure:

- Avoid Foreclosure: A short sale helps you avoid the negative consequences of foreclosure, such as damage to your credit score, difficulty obtaining future loans, and even legal action.

- Minimize Debt: While you won’t be free of all debt, a short sale can help you settle your mortgage balance with the lender for less than the full amount owed.

- Sell Your House on Your Terms: Unlike foreclosure, where the lender controls the sale, a short sale allows you to choose the buyer and negotiate the terms of the sale within certain parameters set by the lender.

- Move On Faster: Short sales usually close quicker than foreclosures, allowing you to move on from the situation and find new housing arrangements sooner.

How does a Short Sale Work?

Here’s a general breakdown of the short sale process:

- Consult with a Real Estate Agent: Working with an experienced real estate agent specializing in short sales is crucial. They can navigate the complexities of the process, negotiate with the lender, and market your property effectively.

- Prepare Financial Documents: Gather proof of financial hardship, such as income statements, bank statements, and hardship letters explaining your inability to make mortgage payments.

- Get the Lender’s Approval: Submit a short sale package to your lender that includes the asking price, justification for the discounted price, and supporting financial documents. The lender will assess your situation and decide whether to approve the short sale.

- Marketing and Negotiations: Once approved, your real estate agent will market the property and attract potential buyers. The lender may have specific guidelines for pricing and buyer qualifications. Negotiations with the buyer and lender may occur during this stage.

- Closing the Sale: If a suitable buyer is found and the lender agrees to the terms, the short sale closes like a traditional sale. You will receive the net proceeds from the sale after covering closing costs and any agreed-upon deficiencies.

Things to Consider before Pursuing a Short Sale:

- Deficiency Judgments: In some cases, the lender may come after you for the remaining balance after the sale, known as a deficiency judgment. Consult with a legal professional to understand the laws in your state regarding deficiency judgments and your potential liability.

- Tax Implications: You may face tax consequences from the forgiven debt in a short sale. Consult with a tax advisor to understand how it might impact your tax situation.

- Credit Score Impact: While a short sale is generally less damaging to your credit score than foreclosure, it can still negatively affect it. Discuss the potential impact with your real estate agent or financial advisor.

I hope this detailed explanation has equipped you with a comprehensive understanding of short sales and how they might work for you. Don’t hesitate to ask if you have further questions or need more specific information tailored to your situation.

Deed in Lieu of Foreclosure: In simple terms, a deed in lieu of foreclosure is a voluntary agreement between a homeowner and their lender. Instead of undergoing the formal foreclosure process, the homeowner transfers the ownership of their property directly to the lender in exchange for the release of their mortgage obligation. Think of it as handing over the keys to avoid the public auction typically associated with foreclosure.

Why Choose a Deed in Lieu?

While also not a magic bullet, there are specific reasons why a deed in lieu might be preferable to foreclosure:

- Avoid the Foreclosure Stigma: A deed in lieu avoids the negative mark of foreclosure on your credit report, offering potential for faster credit score recovery.

- More Control Over Timeline: Unlike the uncertainty of a foreclosure timeline, a deed in lieu lets you negotiate a closing date that works for you, allowing you to plan your move more efficiently.

- Potentially More Money: In some cases, the lender might offer financial incentives, such as covering some closing costs or relocation assistance, to sweeten the deal.

- Minimize Damage to Property: You can avoid potential vandalism or neglect that often occurs with vacant foreclosed properties.

Things to Consider before Pursuing a Deed in Lieu:

Despite its apparent benefits, there are crucial aspects to consider before opting for a deed in lieu:

- Potential Tax Liability: The forgiven debt from the mortgage may be considered taxable income by the IRS, leading to unexpected tax burdens. Consult a tax advisor to understand potential implications.

- Deficiency Judgments: Although not always the case, some lenders may still pursue you for the remaining balance after the sale, depending on your state’s laws and the terms of your mortgage.

- Negotiation Power: Lenders often hold the upper hand in negotiation, and you may not receive the best offer for your property compared to a traditional sale.

- Limited Options: Once you sign the deed, you typically relinquish any claim to the property and its future appreciation.

The Decision-Making Process:

Choosing the right path depends on your unique circumstances and financial goals. Consulting with a qualified real estate agent, financial advisor, and legal professional is crucial. They can analyze your situation, explain the advantages and disadvantages of each option, and guide you towards the best decision for your specific needs.

Ultimately, deeding your property in lieu of foreclosure can be a valuable tool for avoiding the full consequences of foreclosure, but it’s essential to approach it with caution and complete understanding. Take your time, weigh your options carefully, and seek professional guidance to navigate this challenging situation with confidence.

Remember, you’re not alone in facing financial difficulties. Resources and support are available to help you navigate this difficult phase and build a brighter financial future. Don’t hesitate to reach out for assistance and explore all avenues before making a decision that impacts your long-term financial well-being.

Forbearance: Forbearance is a temporary agreement between you and your mortgage lender that allows you to modify your mortgage payments for a predetermined period. This modification can take different forms, depending on your needs and the type of loan you have:

- Payment reduction: The lender agrees to lower your monthly payments for a set period.

- Payment extension: You pay the full amount, but you have more time to catch up on missed payments.

- Deferment: You temporarily suspend all payments (interest may still accrue during this period).

How does Forbearance Work?

To start the process, you need to contact your mortgage servicer (the company that collects your payments) and explain your situation. Be prepared to provide documentation supporting your financial hardship, such as:

- Recent pay stubs

- Bank statements

- Medical bills

- Layoff notices

Your servicer will assess your request and determine if forbearance is the right option for you. If approved, you’ll sign a forbearance agreement outlining the modified payment terms and the duration of the arrangement.

Benefits of Forbearance:

- Avoids Foreclosure: Forbearance helps you stay in your home and avoid the stressful and damaging consequences of foreclosure.

- Provides Breathing Room: It gives you time to get back on your feet financially without the immediate pressure of full mortgage payments.

- Protects Your Credit: While not immune to potential impacts, forbearance generally has a less negative effect on your credit score than foreclosure.

- Offers Options: Depending on your situation, you may choose from different payment modification options to suit your needs.

Things to Consider before Pursuing Forbearance:

- It’s not forgiveness: You’re still responsible for the missed payments, plus any accrued interest. Be prepared to catch up on these payments later, typically through a repayment plan.

- Tax implications: Depending on the type of loan, forgiven or reduced interest during forbearance may be considered taxable income. Consult a tax advisor for clarity.

- Credit score impact: While potentially less damaging than foreclosure, forbearance can still impact your credit score, albeit to a lesser extent.

- Long-term impact: Forbearance is a temporary solution. It’s crucial to address the underlying financial issues to avoid future difficulties.

Making the Right Decision:

Whether forbearance is the right path for you depends on your unique circumstances. Consulting with a financial advisor, housing counselor, or legal professional can help you understand your options, assess the potential consequences, and choose the best course of action for your financial future.

Remember, facing financial hardship doesn’t have to be a solitary battle. Resources and support are available to help you navigate this challenging time and work towards financial stability. Don’t hesitate to reach out for assistance and explore all your options before making a decision that impacts your long-term well-being.

Government Assistance Programs: Facing the foreclosure process in Virginia can feel like a dark tunnel with no light at the end. But for distressed homeowners in the United States, a beacon of hope exists in the form of government assistance programs like the Homeownership Preservation Program (HPP). Let’s delve into how HPP and other similar programs can help you navigate this challenging scenario and keep your house.

Understanding the Homeownership Preservation Program:

The HPP, administered by the U.S. Department of the Treasury, provides financial assistance to eligible homeowners facing imminent foreclosure due to hardship caused by the COVID-19 pandemic. It operates through a network of state and local housing agencies that distribute the funds to eligible individuals.

What kind of assistance does HPP offer?

HPP assistance can take various forms, depending on your specific needs:

- Mortgage payment assistance: Helps cover past-due mortgage payments, delinquent property taxes, and homeowners insurance premiums.

- Refinance assistance: Helps homeowners transition to more affordable mortgages with lower interest rates or longer repayment terms.

- Loss mitigation counseling: Provides personalized advice and guidance to explore loan modification, short sales, or other foreclosure prevention options.

Who is eligible for HPP?

Eligibility for HPP varies slightly by state, but generally, you must meet the following criteria:

- Experienced a financial hardship due to COVID-19, such as job loss, illness, or reduced income.

- Own and occupy your primary residence as your main dwelling.

- Be behind on your mortgage payments.

- Meet income limits set by your state housing agency.

How to apply for HPP:

Contact your state or local housing agency to access your specific program details and application process. You’ll typically need to provide documentation of your financial hardship, income, and ownership of your home.

Beyond HPP: Other government assistance options:

While HPP specifically targets COVID-19 hardships, other government programs offer assistance to homeowners facing foreclosure for various reasons:

- Federal Housing Administration (FHA) Loss Mitigation Programs: Offer options like loan modifications, forbearance agreements, and temporary payment reductions for FHA-insured mortgages.

- Neighborhood Reinvestment Corporation (NRC): Provides grants and low-interest loans to help eligible homeowners avoid foreclosure and stabilize their housing situation.

- HOPE for homeowners: A program offering grants to eligible homeowners facing imminent foreclosure.

Remember:

- Early intervention is key: Contact your lender or a housing counselor as soon as you experience financial difficulty to explore foreclosure prevention options.

- Seek professional guidance: Housing counselors and legal professionals can help you navigate the complexities of government assistance programs and choose the best option for your situation.

- Act quickly: Don’t wait until the last minute to seek help. Many programs have deadlines and limited funding.

Facing the foreclosure process in Virginia can be daunting, but it’s crucial to know that you’re not alone. Government assistance programs like HPP and others offer a lifeline to save your home and get back on your feet financially. By understanding these programs, acting proactively, and seeking professional guidance, you can navigate this challenging situation and emerge with a brighter future.

Additional Resources:

Consumer Financial Protection Bureau: https://www.consumerfinance.gov/

U.S. Department of Housing and Urban Development (HUD): https://www.hud.gov/

National Fair Housing Alliance: https://nationalfairhousing.org/

Remember, knowledge is power! Understand Virginia foreclosure laws and don’t hesitate to reach out for help and utilize the resources available to overcome this hardship and secure your housing stability.

Selling to a Cash Buyer: A Quick Escape Route:

Cash buyers like us offer a unique option. We can close quickly, often in as little as two weeks, providing much-needed relief from the pressure of looming foreclosure. Here’s why selling to a cash buyer might be right for you:

- Fast Sale, Minimal Stress: No waiting for traditional financing, no open houses, no drawn-out negotiation. We buy your house as-is, in its current condition, eliminating the need for costly repairs or upgrades.

- Fair Prices: We offer fair market value for your property, not taking advantage of your difficult situation. We understand the emotional toll of foreclosure and strive to treat you with respect and empathy.

- Certainty and Control: Cash buyers bring certainty to the table. The deal is secure, closing is guaranteed, and you regain control over your timeline by choosing a closing date that works for you.

Contact us as soon as possible if you are facing foreclosure, we can help! Please DO NOT wait until a week or two before the scheduled auction before reaching out to us for a cash offer on your property…oftentimes that is too late to get the property closed and settled in time.

Parting Words

Remember, every foreclosure situation is unique. Consulting with legal and financial professionals can provide invaluable guidance based on your specific circumstances.

Foreclosure may seem like a dark tunnel, but there is light at the end once you understand your options and foreclosure process in Virginia. Armed with knowledge, empowered by options, and with the supportive hand of resources available, you can navigate this challenge and emerge on the other side, brighter and stronger.

Additional Resources:

- Virginia Housing Development Authority: https://www.virginiahousing.com/en

- National Fair Housing Alliance: https://nationalfairhousing.org/

- Legal Aid Justice Center: https://www.justice4all.org/

Note: This article is for informational purposes only and should not be construed as legal advice. Please consult with a qualified attorney for specific legal guidance.